Overview

Navigating insurance home care options can be overwhelming, and it’s important to feel supported during this journey. This article offers essential tips to help families understand their choices better. By exploring various insurance policies, such as long-term care insurance and Medicare, families can secure the necessary support for their loved ones while managing financial concerns.

Understanding these options is crucial, especially as the demand for home health services continues to grow. Case studies and statistics highlight the increasing need for effective care solutions. In addition, recognizing the emotional weight of these decisions can help families feel more empowered.

We want you to know that you are not alone in this process. Many families face similar challenges, and there are resources available to guide you. As you explore your options, remember that your loved one’s comfort and well-being are our top priorities. Together, we can navigate this path toward securing the care that is needed.

If you have questions or need support, please reach out. We’re here for you every step of the way.

Introduction

In a world where the aging population is rapidly increasing, the need for home care services is more pressing than ever. Families often face the daunting task of navigating complex insurance options to secure the best care for their loved ones. At Best Care Nurses Registry, a family-owned provider in South Florida since 1980, we understand these challenges and are here to offer expert guidance tailored to your individual needs.

With the growing demand for personalized care solutions, understanding the intricacies of home care insurance is essential. Not only does it alleviate financial strain, but it also ensures that seniors receive the compassionate support they deserve. From long-term care insurance to Medicaid options, we provide valuable insights and practical advice to help families make informed decisions in this critical area of caregiving.

We’re here for you, ready to support you in this journey. Your comfort and the well-being of your loved ones are our top priorities.

Best Care Nurses Registry: Expert Guidance on Insurance Home Care Options

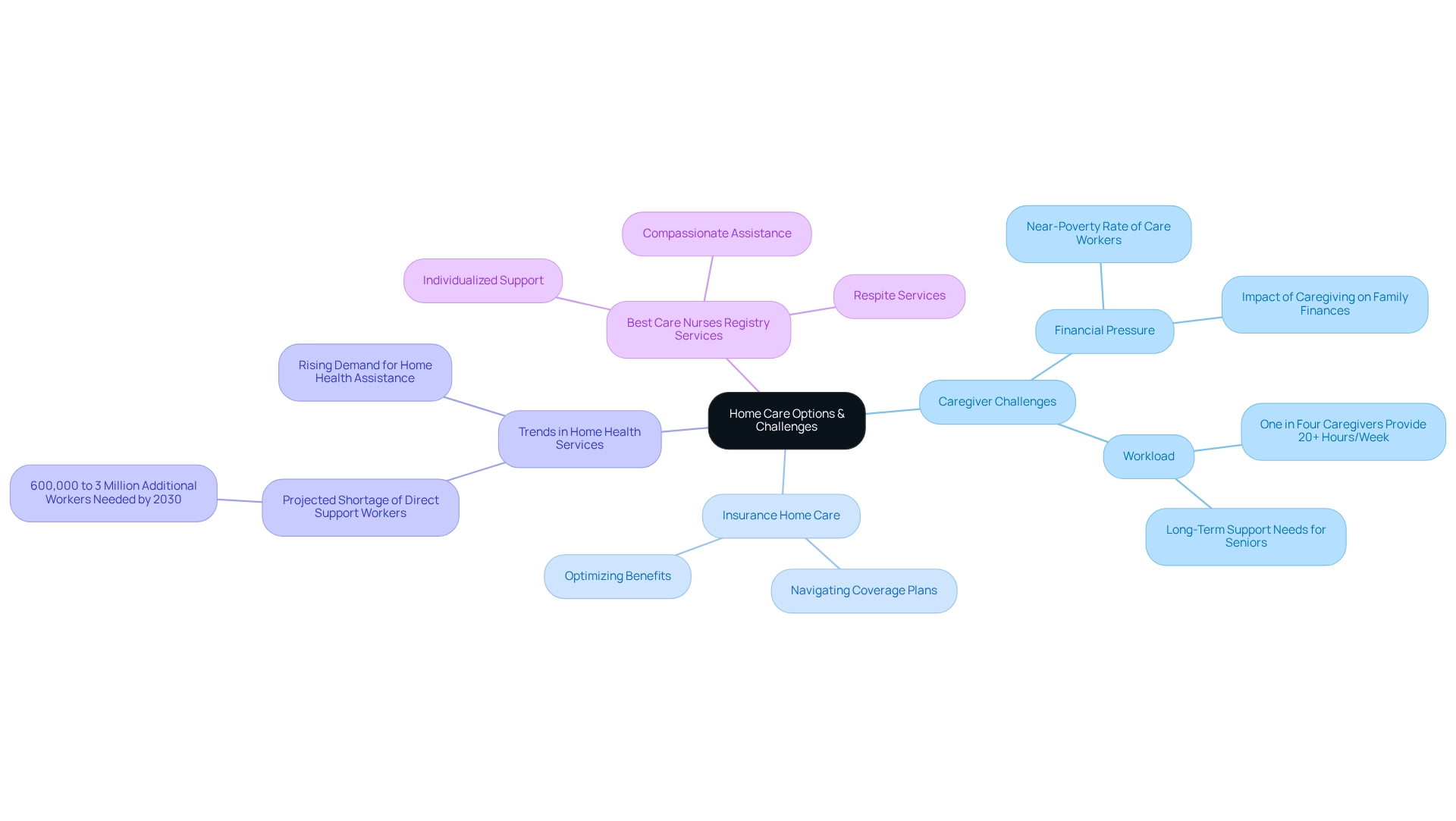

Best Care Nurses Registry has been a reliable family-operated home health service provider in South Florida since 1980, specializing in private duty assistance. We understand that navigating insurance home care can be overwhelming, and our considerable experience in managing coverage choices ensures that you receive customized support tailored to your unique needs. It’s important to recognize that one in four household caregivers provides 20 or more hours of assistance each week, which can lead to financial pressure. In fact, full-time support workers face a near-poverty rate that is twice that of all full-time California employees, highlighting the significant financial challenges caregivers encounter. At Best Care, we’re dedicated to helping families understand their coverage plans and optimize their benefits, alleviating the stress associated with caregiving responsibilities.

Current trends indicate a rising demand for home health assistance services, with projections suggesting a substantial shortage of direct support workers by 2030, estimating a need for between 600,000 to over 3 million additional employees. This underscores the importance of strategic planning in navigating insurance home care to ensure quality services. Moreover, individuals aged 65 and above typically live an average of four to eight years following an Alzheimer’s diagnosis, with some living up to 20 years with the condition. This emphasizes the long-term support needs of seniors. Best Care’s commitment to individualized, compassionate assistance, including respite services, positions us as a leader in the sector, allowing families to focus on their loved ones while receiving the best possible support.

Don’t just take our word for it—hear from our satisfied clients: “Best Care Nurses Registry has been a lifesaver for our family. Their team is empathetic and informed, facilitating a smooth transition to home assistance.” We invite you to reach out to us today at (888) 203-2529 to discuss your home health needs and discover how we can support you.

Understand Long-Term Care Insurance Coverage for Home Care

Long-term care insurance (LTCI) plays a vital role in covering costs associated with insurance home care, which includes both personal support and skilled nursing. It is crucial for households to thoroughly examine the specific benefits detailed in their policies, as coverage can vary significantly. A significant percentage of LTCI policies include provisions for services rendered by licensed professionals, yet they may exclude non-medical assistance, such as companionship or light housekeeping. This distinction is crucial for families to comprehend when preparing for their loved ones’ support needs.

In 2025, revisions to long-term support benefits emphasize the significance of mental sharpness in qualifying for coverage. Individuals showing signs of cognitive decline may encounter difficulties in securing approval, as these conditions often relate to heightened long-term support needs. This highlights the importance for households to act proactively in securing insurance before health issues arise.

Practical instances demonstrate how households have effectively used LTCI to obtain in-home assistance. For example, a family in South Florida utilized their LTCI policy to cover the expenses of a registered nurse who offered expert assistance for their elderly parent, enabling them to sustain a higher quality of life at home. This efficient application procedure guarantees that qualified individuals can obtain long-term insurance when required, enabling prompt assistance for support services. Such cases demonstrate the tangible benefits of understanding and maximizing LTCI coverage.

As of 2025, statistics indicate that coverage under the LTC Plan continues as long as premiums are paid, reflecting a growing recognition of the need for in-home support. Families ought to recognize that insurance home care can greatly reduce the financial strain linked to long-term care insurance, allowing them to concentrate on their loved ones’ well-being instead of the challenges of expenses.

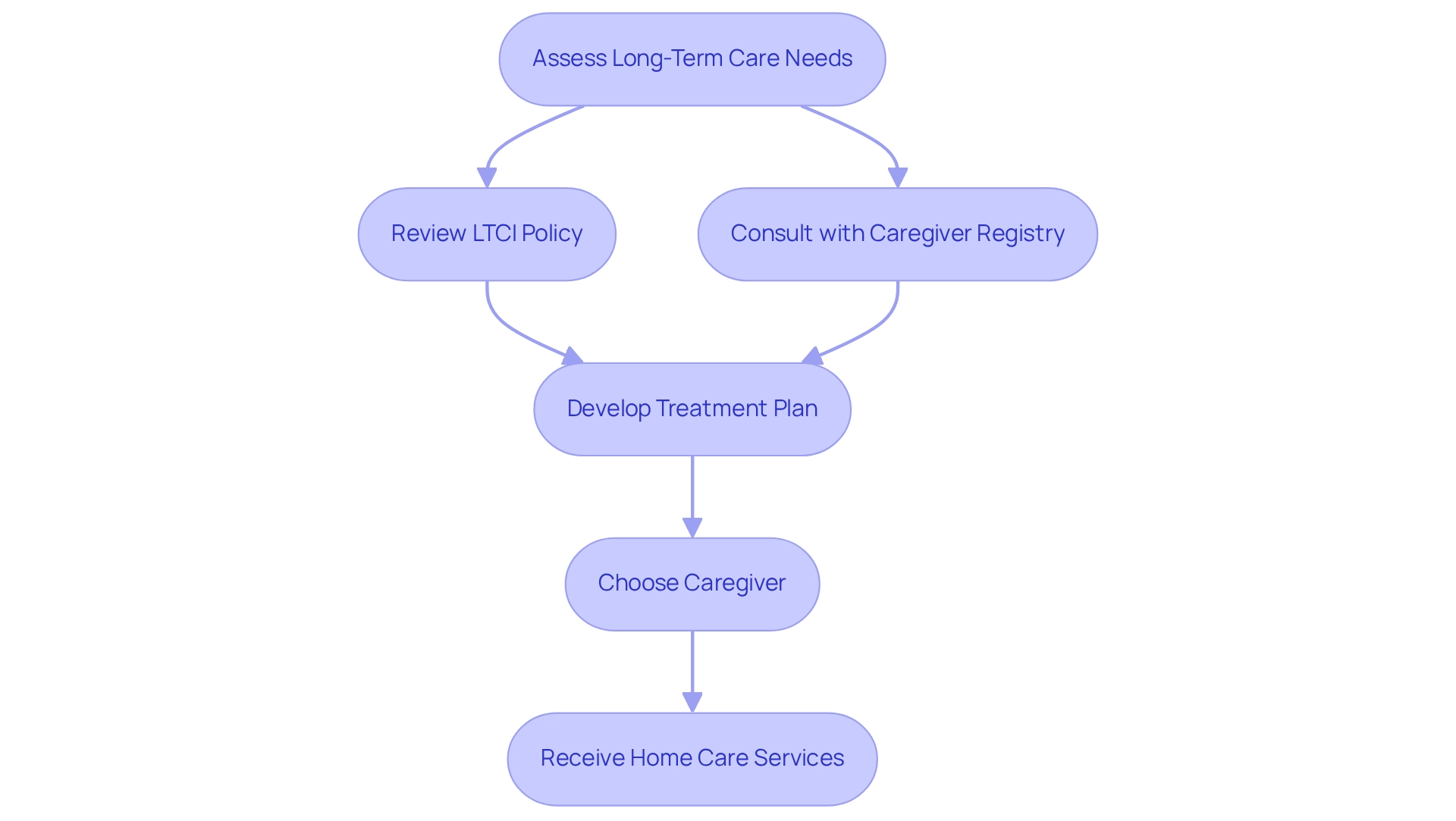

To engage with Best Care Nurses Registry, families can follow these simple steps:

- Call to speak with our friendly staff to discuss your needs and answer any questions you have.

- We’ll talk about your circumstances with you or your loved one and pursue a treatment plan from your physician that ideally addresses your needs.

- We will refer compassionate caregivers whom you choose to work with.

With Best Care Nurses Registry, households can discover adaptable and empathetic home health services customized to their requirements, guaranteeing that their loved ones obtain the individualized assistance they merit. As Jesse Slome, director of the American Association for Long-Term Care Insurance, observes, “That possible tax deduction can be a significant advantage after retirement and something seniors should contemplate when exploring their long-term assistance protection choices.” By navigating the intricacies of LTCI, families can ensure they are well-prepared to meet their loved ones’ needs effectively.

Explore Different Types of Home Care Services Available

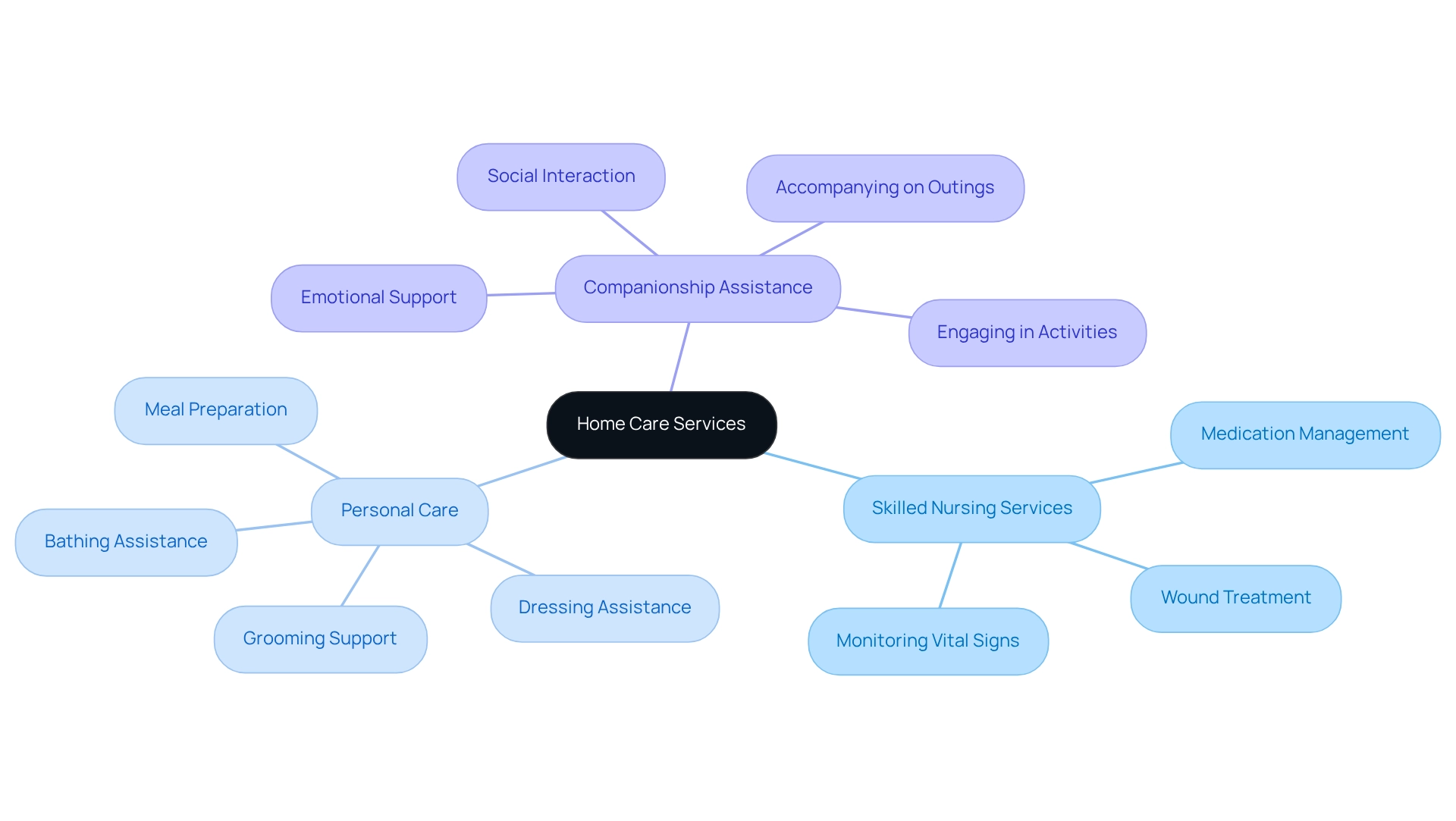

Insurance home care includes three primary categories: skilled nursing assistance, personal assistance, and companionship services.

-

Skilled nursing services, provided by registered nurses (RNs) or licensed practical nurses (LPNs), include essential medical assistance such as medication management, wound treatment, and monitoring vital signs. This level of care is vital for individuals with complex health needs or chronic conditions that require professional oversight.

-

Personal care focuses on assisting with daily living activities, including bathing, dressing, grooming, and meal preparation. This support ensures that individuals maintain their personal hygiene and comfort. Such offerings are especially crucial for seniors or individuals with disabilities who may find these tasks challenging to perform independently.

-

Companionship assistance provides emotional support and social interaction, both of which are critical for mental well-being. Caregivers from Best Care Nurses Registry engage clients in conversation, accompany them on outings, and participate in activities that promote socialization. This helps combat feelings of loneliness and isolation, providing emotional comfort that is essential for ensuring the safety and joy of your loved ones at home.

Best Care Nurses Registry offers adaptable options, including ‘No minimums!’ and ’24 Hour Assistance Available,’ allowing families to customize support to their specific needs. As of 2025, the demand for insurance home care services is increasing, particularly in skilled nursing support. Recent statistics indicate a significant increase in spending on insurance home care services, reflecting a broader trend towards in-home assistance as families seek to provide support in a familiar environment. This shift is underscored by a recent survey involving 47 health plan leaders, which highlighted the growing acknowledgment of the value of home services. Paul Pino, Chief Growth and Analytics Officer at Integrated Home Support Solutions, remarked, ‘The evolution of home assistance offerings is a testament to the changing needs of our population, highlighting the significance of customized support options.’

Understanding these classifications is crucial for families when selecting the appropriate level of support for their loved ones. For instance, families may opt for skilled nursing support when health needs are critical, while personal care might be preferred for individuals who require assistance with daily tasks but not medical procedures. Companionship services can be an excellent choice for those needing social interaction and emotional support. By recognizing the unique advantages of each type of assistance, families can make informed choices that best meet the needs of their loved ones. Additionally, reviewing the CNA/HHA caregiver FAQ can provide valuable insights for assessing the necessity of caregiver assistance.

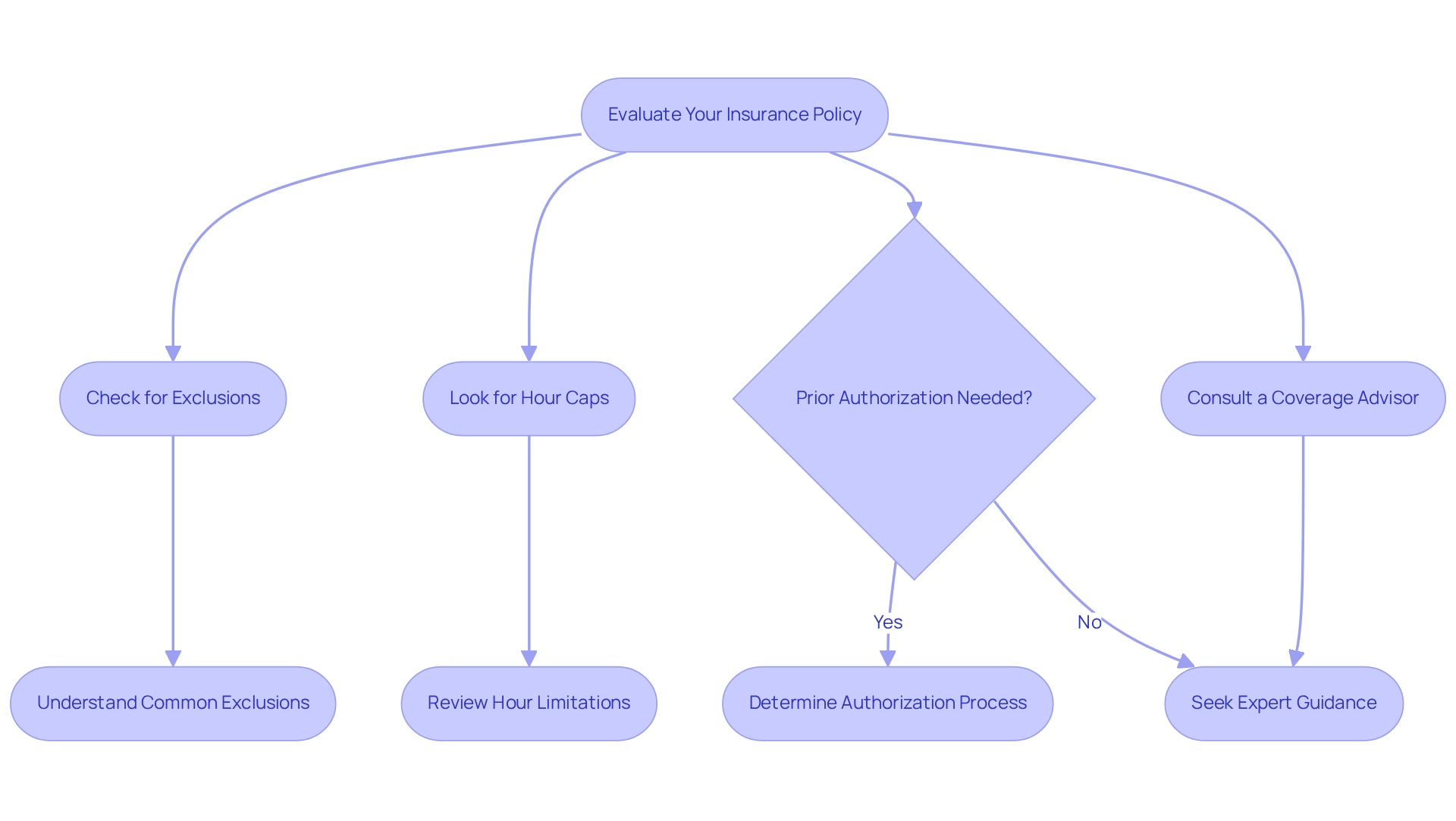

Evaluate Your Insurance Policy for Home Care Coverage

When evaluating your insurance home care coverage plan, it’s essential to consider specific clauses that directly affect your benefits. Are you aware of the exclusions that could limit your coverage? These can significantly affect your options. Additionally, take a moment to check for any caps on the number of hours covered each week and whether prior authorization is necessary for services. Historically, 70 to 80 percent of individuals with traditional policies have experienced premium increases. This underscores the importance of understanding these elements to avoid unexpected costs and ensure you maximize your benefits.

At Best Care Nurses Registry, we’re here to support you. We accept most Long Term Care plans directly on your behalf, allowing you to instruct your provider to pay us directly through a form known as an Assignment of Benefits (AOB). This simplifies your experience, as we handle all the necessary paperwork and await payment from the carrier. It’s important to note that Medicare does not cover activities of daily living, such as bathing, grooming, and meal preparation, which are typically addressed through insurance home care services provided by private duty caregivers. Many families have found that having a knowledgeable third party assist in evaluating their options leads to better-informed decisions and potentially more favorable coverage outcomes.

Consulting with a coverage advisor can provide clarity on complex terms and help you navigate the nuances of your policy. As highlighted in the case study ‘Navigating Long-Term Support Options,’ the field of long-term support varies by state. Consulting with agents can guide individuals in finding the most suitable policies for their needs. Furthermore, you might be able to pay premiums without taxes using funds from a health savings account, accessible only to individuals in specific health plans, as indicated by Benz. As the landscape of insurance home care evolves, particularly with changes anticipated in 2025, staying informed about key clauses and common exclusions will empower families to make the best choices for their loved ones.

Learn About Medicare’s Role in Home Care Insurance

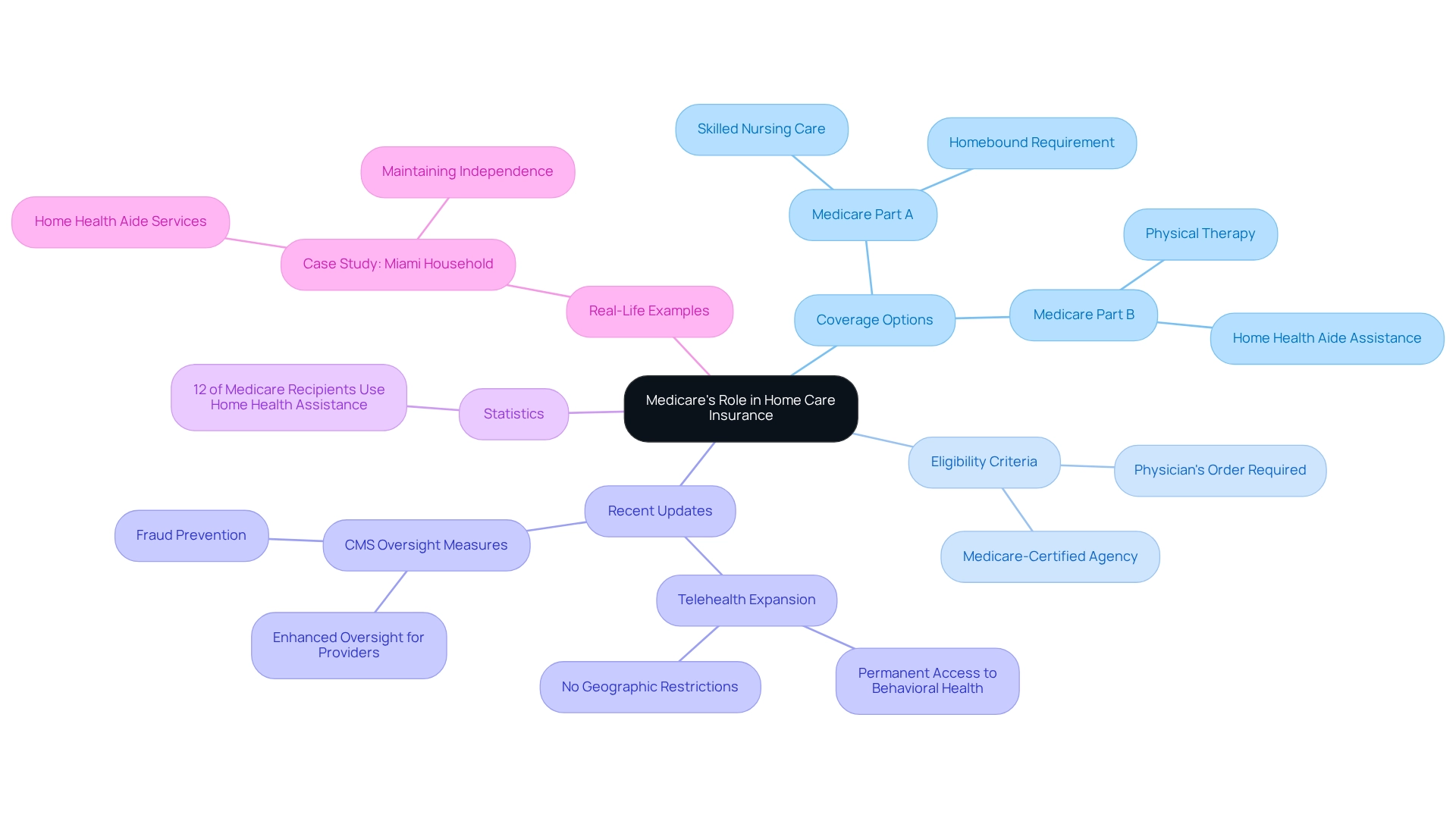

Medicare provides coverage for various home health options, contingent upon meeting specific criteria. For instance, Medicare Part A can cover skilled nursing care if the patient is homebound and needs occasional skilled assistance. Meanwhile, Medicare Part B extends coverage to medically necessary services, including physical therapy and home health aide assistance. Understanding these provisions is essential for families aiming to optimize their Medicare benefits.

Recent updates in 2025 have further clarified Medicare’s role in home insurance, with a notable expansion in coverage options. Did you know that around 12% of Medicare recipients utilize home health assistance? This statistic highlights the program’s importance in aiding seniors and those with chronic conditions. Furthermore, there are no geographic limitations for originating locations for Medicare behavioral and mental telehealth provisions, which significantly improves access to assistance for beneficiaries.

Families ought to recognize that Medicare’s coverage for home health services encompasses conditions such as the need for a physician’s order and the stipulation for assistance to be delivered by a Medicare-certified agency. Staying informed about these regulations is crucial to effectively navigating the complexities of insurance home care. As Kimberly Lankford wisely states, “Medicare caregiving support: 12 things you should know,” emphasizing the necessity for households to comprehend their options.

For example, a household in Miami recently utilized Medicare to secure home health aide services for their elderly parent, allowing them to maintain independence while receiving necessary support. By understanding Medicare’s offerings, individuals can better advocate for their loved ones and ensure they receive the necessary support. Additionally, the Centers for Medicare & Medicaid Services (CMS) has enacted measures to improve oversight of providers, guaranteeing that beneficiaries receive quality services while reducing the risk of fraud. These actions are essential for households looking for home health assistance, as they help ensure that the support offered meets high standards.

At Best Care Nurses Registry, we understand the challenges that caregivers encounter. Our adaptable and empathetic home health assistance is intended to offer individualized support, guaranteeing that your loved one obtains the attention they require while you can concentrate on your own duties. With our carefully screened caregivers, you can have peace of mind knowing that your family member is safe and happy, allowing you to reconnect with your loved ones and manage your daily tasks effectively.

Understand Medicaid Options for Home Care Services

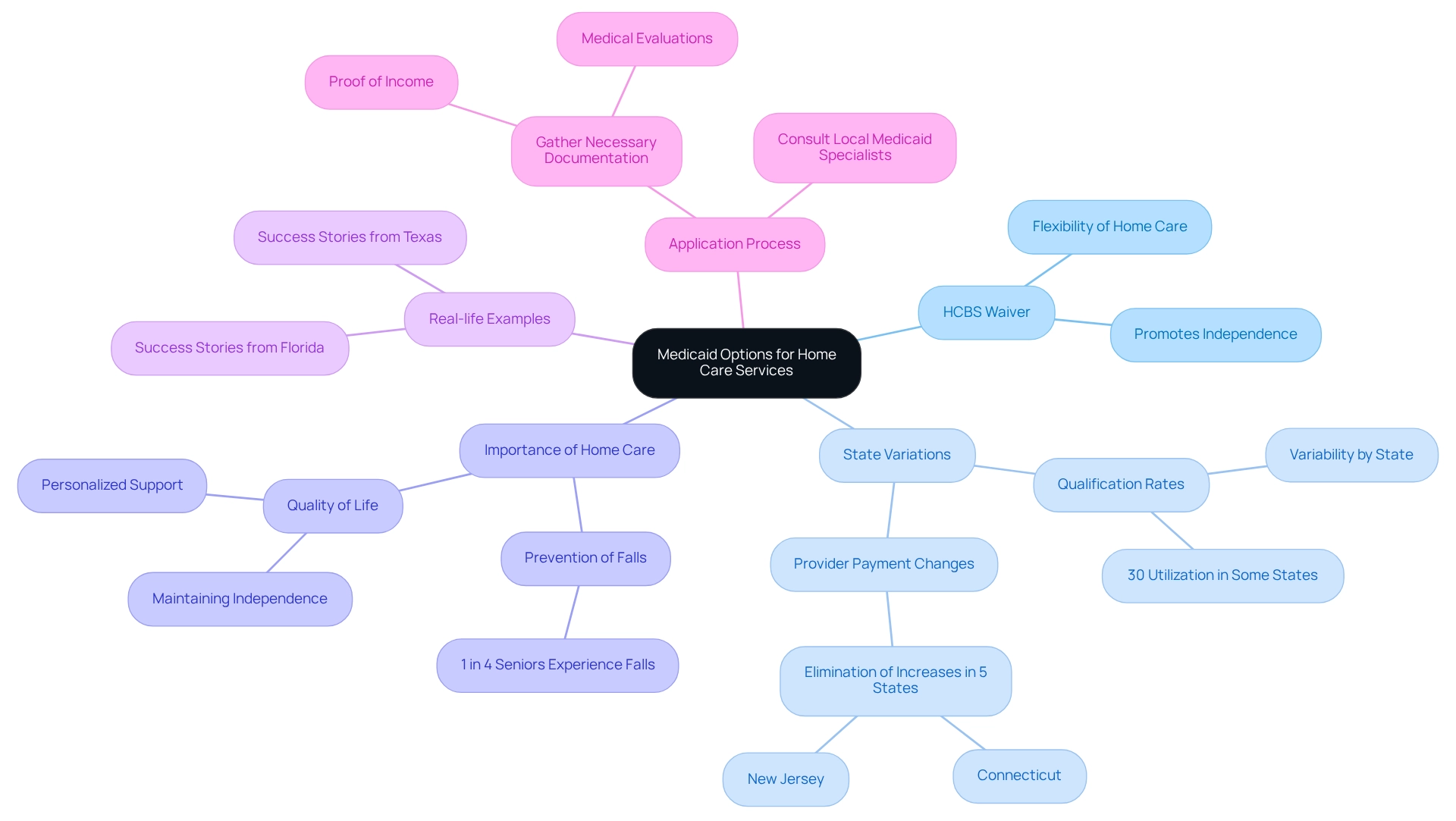

Medicaid offers various programs designed to support qualified individuals with insurance home care, tailored to meet the specific needs of each state. Among these, the Home and Community-Based Services (HCBS) waiver stands out, allowing individuals to receive insurance home care support in the comfort of their homes instead of in institutional settings. This flexibility is essential, as studies show that maintaining independence significantly enhances the quality of life for seniors and those requiring medical support.

In fact, one in four individuals aged 65 and older experiences a fall annually, highlighting the importance of insurance home care in preventing such incidents. In 2025, data reveals that qualification rates for Medicaid insurance home care programs vary greatly by state, with some states reporting that as many as 30% of seniors utilize these options. Families should carefully explore their state’s Medicaid offerings to identify available assistance and understand the application process.

For instance, real-life stories illustrate how families in states like Florida and Texas have successfully leveraged Medicaid and insurance home care to cover essential home assistance, alleviating the financial burden associated with caregiving. Experts in Medicaid initiatives emphasize the importance of understanding HCBS waiver programs, pointing out that these options not only provide vital support but also promote dignity and independence among beneficiaries.

Best Care Nurses Registry exemplifies this commitment to quality of life by offering comprehensive insurance home care, which includes flexibility, companionship, and personalized support tailored to each client’s needs. Testimonials from families who have benefited from these services highlight the positive impact on their loved ones’ lives.

As states continue to adjust their Medicaid programs, staying informed about updates and changes is crucial for individuals seeking support. Notably, five states, including Connecticut and New Jersey, plan to eliminate provider payment increases once federal funds are exhausted, which may influence future Medicaid services.

To apply for insurance home care benefits, families should gather necessary documentation, such as proof of income and medical evaluations, and consult with local Medicaid specialists who can guide them through the process, ensuring they maximize their benefits efficiently. Best Care Nurses Registry emphasizes the importance of individualized support that helps clients live comfortably and with dignity in their own homes.

Compare Different Insurance Plans for Home Care

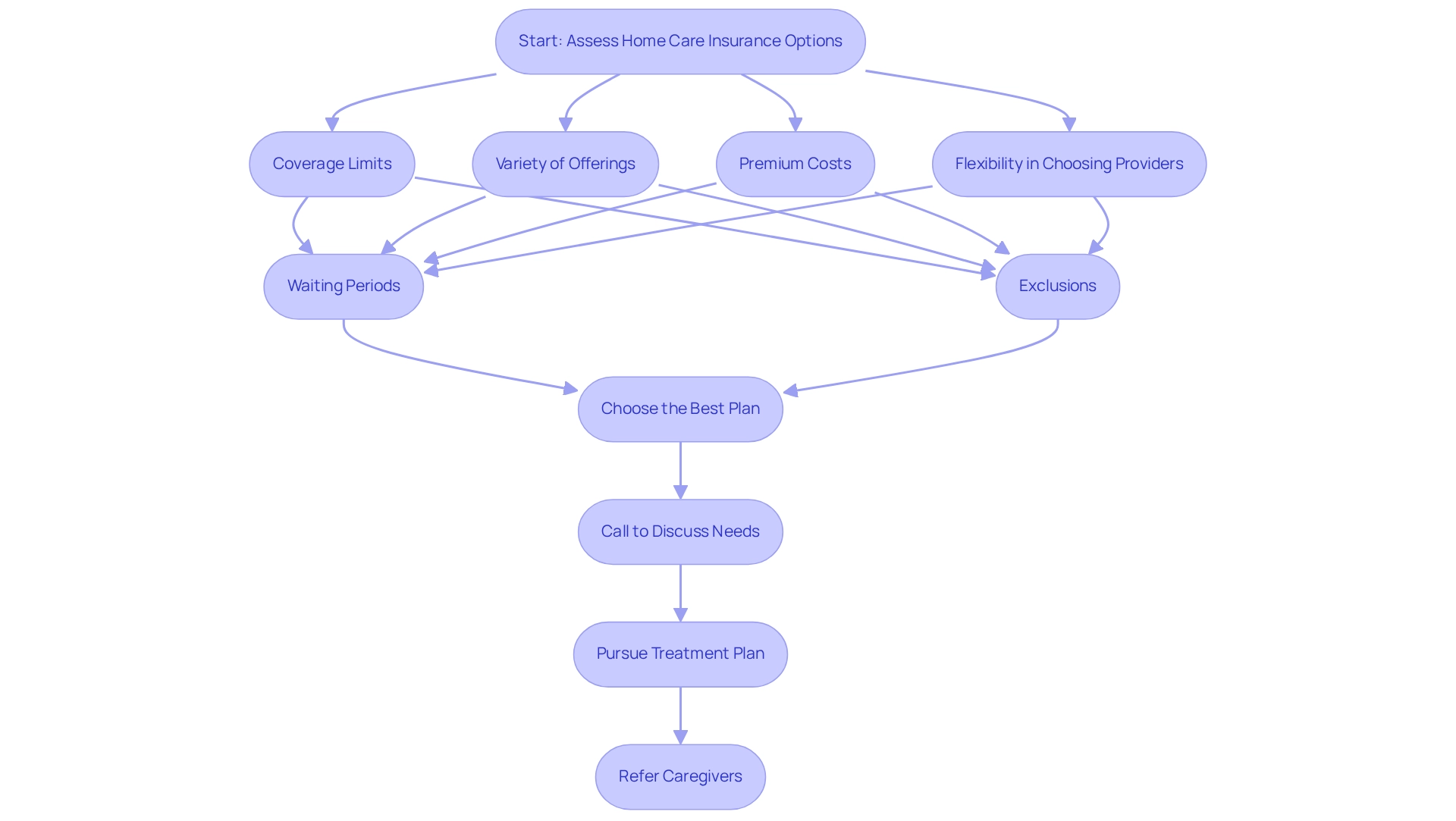

When assessing options for insurance home care, it’s vital to consider several important factors, such as coverage limits, the variety of offerings, and premium costs. Families should prioritize plans that offer flexibility in choosing providers and steer clear of those with strict limitations on service hours. Additionally, examining any waiting periods or exclusions that could affect coverage is crucial.

Recent trends indicate that, as of 2025, many households are opting for plans that not only cover basic services but also include additional support options. This shift reflects a growing demand for comprehensive care solutions. Notably, states are required to develop capitation rates for Medicaid to achieve a Medical Loss Ratio (MLR) of at least 85%, significantly influencing the financial aspects of insurance plans. A thorough comparison of available plans enables households to select the one that best aligns with their unique needs, ensuring they receive the necessary support without undue financial burden.

As Elizabeth Hinton pointed out, despite millions of disenrollments during the unwinding, nearly 8 million more individuals were enrolled in Medicaid/CHIP in October 2024 than in February 2020. This statistic emphasizes the increasing reliance on insurance home care services provided by Medicaid. Furthermore, understanding the implications of waiting periods and exclusions is essential, especially since recent reports indicate that 34 MCO states require remittance payments when an MCO fails to meet state minimum MLR requirements.

Interacting with a considerate provider like Best Care Nurses Registry can enhance this process. They offer customized support plans tailored to specific needs, ensuring that your loved ones receive the assistance they require for their well-being. To embark on this journey, households can follow a simple step-by-step process:

- Call to speak with our helpful staff to discuss your needs and address any questions you may have.

- We’ll talk about your circumstances with you or your loved one and pursue a treatment plan from your physician that ideally addresses your needs.

- We will refer compassionate caregivers whom you choose to work with.

A brighter future for your loved one and your family is just a phone call away. CALL (888) 203-2529 to schedule a call.

Communicate Effectively with Your Insurance Provider

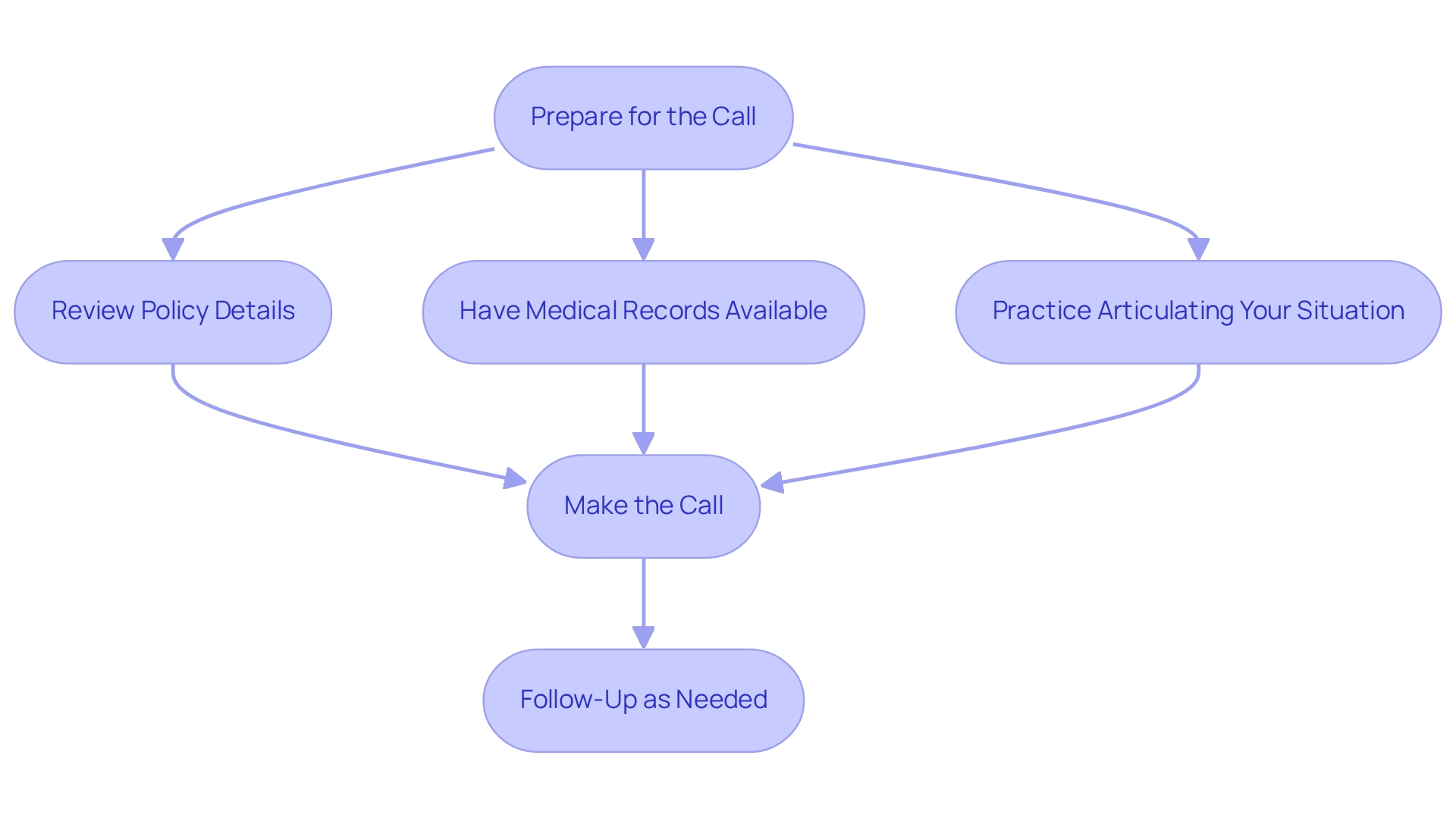

Effective communication with your coverage provider is essential for ensuring that your home care needs are met. Begin by clearly articulating your specific requirements and concerns. Preparing a list of questions in advance can help you stay organized during the call. Additionally, jotting down notes during the discussion allows you to capture significant details and responses.

At Best Care Nurses Registry, we accept most Long Term Care policies directly on your behalf, simplifying the process for you. Our dedicated team is here to assist you with the necessary documentation, including the assignment of benefits (AOB), which enables us to work directly with your coverage provider. If you encounter challenges, please feel free to ask for clarification or request to speak with a supervisor for further assistance. Building a connection with your representative can lead to more seamless interactions, making it easier to address your needs.

To prepare for a call with your provider, consider these practical suggestions:

- Review your policy details beforehand

- Have your medical records available

- Practice articulating your situation clearly

Remember, our highly skilled team at Best Care Nurses Registry is also available to help you with coverage inquiries, further enhancing your overall experience. We’re here for you, and your comfort is our priority.

Keep Detailed Records of Care and Expenses for Claims

Keeping detailed documentation of all support offerings and associated costs is vital for effectively submitting reimbursement claims. Families should carefully record the dates and types of services received, along with any interactions with their coverage provider. Additionally, keeping receipts and invoices for all home care expenses is equally important. This organized approach not only streamlines the claims process but also significantly increases the likelihood of receiving timely reimbursements.

At Best Care Nurses Registry, we understand that navigating insurance can be challenging. That’s why we accept most insurance home care plans directly on your behalf, simplifying the payment process for you. Most carriers require a form called an Assignment of Benefits (AOB) to be completed by the policyholder, allowing you to direct the carrier to pay us directly. We handle all necessary paperwork and can often start services right away, minimizing out-of-pocket expenses unless your policy has an elimination period.

It is important to note that Medicare does not cover assistance with activities of daily living, such as bathing and grooming, which private duty caregivers provide. Medicare typically focuses on skilled visits, which are often short in duration. Families overseeing home support expenses must be diligent in documenting assistance to maximize their benefits. By maintaining comprehensive records, households can more effectively manage the intricacies of long-term coverage, ensuring they are ready for any questions from their providers. Expert guidance highlights that meticulous documentation can ease the pressure of handling claims. Providers of coverage and collective health plans must offer a standardized glossary of terms frequently utilized in health coverage, such as ‘deductible’ and ‘co-payment,’ which can assist households in comprehending their policies more effectively. Practical examples demonstrate how households that carefully monitor support provisions and costs frequently encounter more seamless claims procedures and faster reimbursements.

Moreover, it is essential to acknowledge the racial and economic inequalities in long-term assistance and resources (LTSS). Research shows that people of color encounter higher levels of severe LTSS needs and fewer financial means, highlighting the significance of comprehensive documentation to guarantee fair access to benefits.

To effectively record services for coverage, households can follow these practical steps:

- Create a designated folder for all service-related documents.

- Use a spreadsheet to log dates, services rendered, and caregiver information.

- Maintain a record of all communications with coverage providers.

- Regularly review and update records to ensure accuracy.

As the older demographic continues to expand, the significance of efficient record-keeping for claims related to insurance home care cannot be emphasized enough. This practice acts as an essential resource for households aiming to handle expenses and guarantee their loved ones obtain the required assistance. Comprehending average reimbursement durations for home support claims can also assist families in predicting when they may obtain funds, further highlighting the necessity for prompt and precise documentation.

Seek Professional Advice for Navigating Home Care Insurance

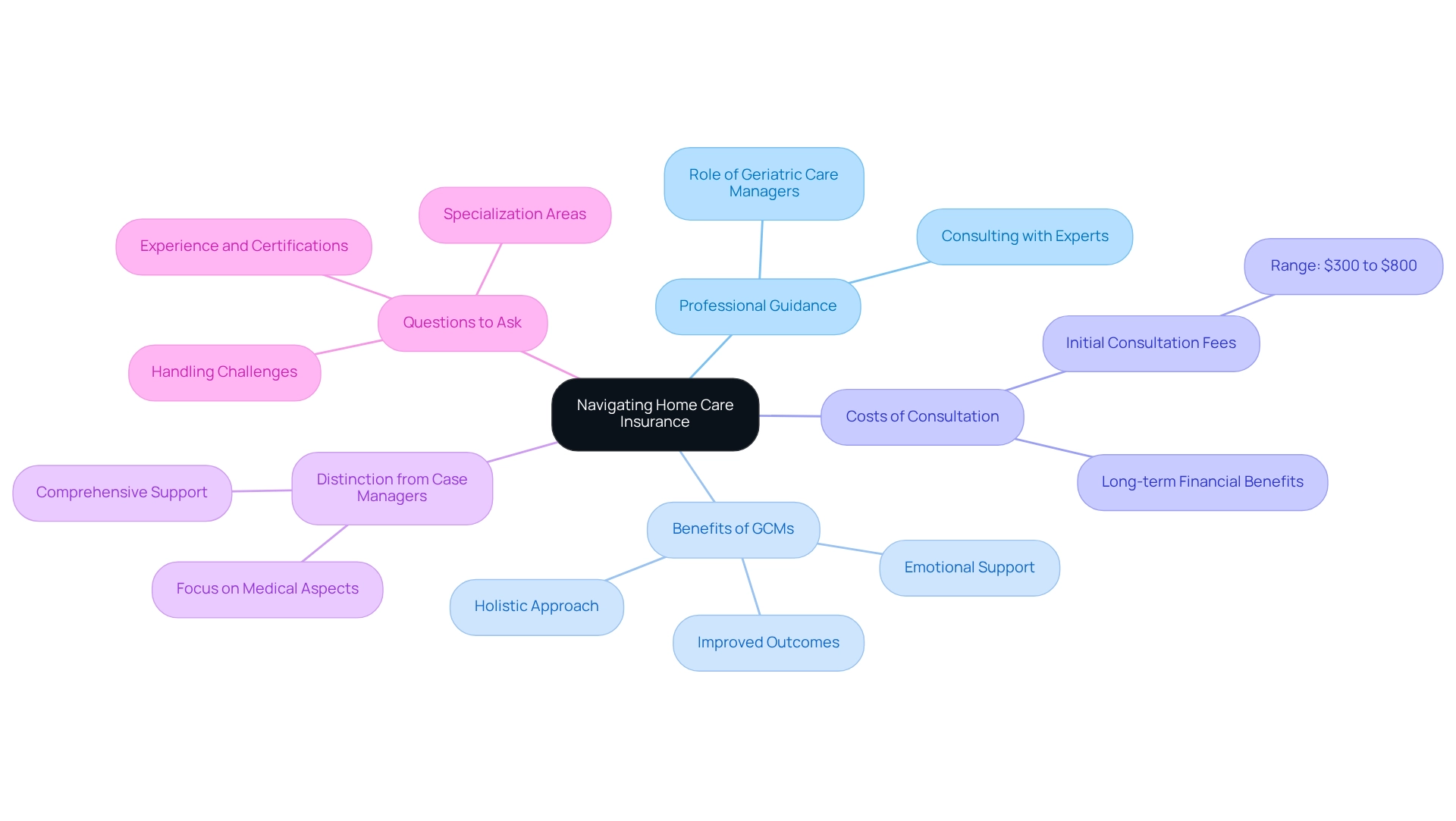

Navigating home assistance coverage can be a daunting task, but seeking expert guidance can truly simplify the journey. Consulting with a geriatric support manager or an insurance advisor specializing in long-term assistance can provide invaluable support. These professionals are dedicated to helping families understand their options, evaluate different policies, and create a comprehensive support strategy tailored to their financial situations and unique needs.

Geriatric management professionals (GMPs) play a vital role in empowering older individuals to live fulfilling lives while addressing their specific challenges. They offer a holistic approach to support, distinguishing themselves from case managers who primarily focus on medical concerns. It’s important to note that Medicare does not cover the services of geriatric managers, a significant financial consideration for families. Initial consultations with GCMs typically range from $300 to $800, yet this investment can lead to considerable long-term benefits, such as improved navigation of coverage options and enhanced planning for care. Families often find that engaging a GCM not only clarifies the complexities of coverage but also alleviates the emotional burden associated with caregiving. Many families have successfully sought assistance from GCMs to manage long-term assistance claims, ensuring they maximize their benefits while receiving essential support. This expert guidance is particularly valuable in 2025, as the landscape of home insurance continues to evolve. Furthermore, GCMs can provide insights into the nuances of various insurance policies, helping families make informed decisions. Their expertise is crucial in identifying potential obstacles and formulating strategies to address them.

As Amie Clark from the Aging Life Care Association (ALCA) emphasizes, GCMs offer events, education, and resources that support their members. Families considering the employment of a GCM should prepare a list of questions for the interview, including inquiries about their experience, certifications, and areas of specialization.

The distinction between GCMs and case managers is significant; while case managers primarily focus on medical aspects, GCMs provide a more comprehensive approach to support. This understanding aids families in selecting the right type of care for their elderly loved ones. Experts in the field highlight that the advantages of professional guidance in navigating insurance home care are substantial, leading to improved outcomes for both seniors and their families. Remember, you’re not alone in this journey—support is available, and we’re here for you.

Conclusion

As the demand for home care services continues to rise, it becomes increasingly vital for families to understand the intricacies of insurance options. This article highlights the importance of navigating various policies, including long-term care insurance, Medicaid, and Medicare, to secure the best possible care for your loved ones. By familiarizing yourself with the specific benefits, exclusions, and requirements of these policies, you can alleviate financial strain and ensure that your elderly relatives receive the compassionate support they deserve.

Furthermore, effective communication with insurance providers and maintaining detailed records of care and expenses are essential practices. These steps not only streamline the claims process but also empower you to make informed decisions regarding your care options. Seeking professional advice from geriatric care managers can further enhance this journey, providing the necessary expertise to navigate complex insurance landscapes and create tailored care plans.

Ultimately, prioritizing the well-being of your loved ones through informed insurance choices is essential in today’s evolving home care environment. With the right guidance and support, you can confidently navigate the challenges of caregiving, ensuring that your elderly relatives receive the quality care that promotes dignity and independence. Taking proactive steps today can lead to a brighter and more secure future for both you and your loved ones.

Frequently Asked Questions

What services does Best Care Nurses Registry provide?

Best Care Nurses Registry offers three primary categories of services: skilled nursing assistance, personal assistance, and companionship services.

What is included in skilled nursing services?

Skilled nursing services, provided by registered nurses (RNs) or licensed practical nurses (LPNs), include essential medical assistance such as medication management, wound treatment, and monitoring vital signs.

What types of support are offered under personal care?

Personal care focuses on assisting with daily living activities, including bathing, dressing, grooming, and meal preparation, ensuring individuals maintain their personal hygiene and comfort.

How does companionship assistance benefit clients?

Companionship assistance provides emotional support and social interaction, helping combat feelings of loneliness and isolation while promoting mental well-being through conversation and activities.

What is the significance of long-term care insurance (LTCI) in home health services?

Long-term care insurance (LTCI) plays a vital role in covering costs associated with insurance home care, including personal support and skilled nursing, although coverage can vary significantly between policies.

What should families consider when reviewing LTCI policies?

Families should thoroughly examine the specific benefits detailed in their LTCI policies, as many may exclude non-medical assistance like companionship or light housekeeping.

What trends are affecting the demand for home health assistance services?

There is a rising demand for home health assistance services, with projections suggesting a substantial shortage of direct support workers by 2030, necessitating strategic planning for quality services.

How can families engage with Best Care Nurses Registry for home health services?

Families can engage with Best Care Nurses Registry by calling to discuss their needs, pursuing a treatment plan with their physician, and selecting compassionate caregivers to work with.

What are the financial challenges faced by caregivers?

Many household caregivers provide significant hours of assistance each week, leading to financial pressure, with full-time support workers facing a near-poverty rate that is twice that of all full-time California employees.

How does Best Care Nurses Registry support families in navigating insurance home care?

Best Care Nurses Registry helps families understand their coverage plans and optimize their benefits, alleviating the stress associated with caregiving responsibilities.