Overview

Navigating the world of respite care funding can feel overwhelming, but understanding your options is the first step towards easing the financial burdens of caregiving. Primary funding sources include:

- Medicare

- Medicaid

- Veterans Affairs

- Private insurance

- Nonprofit organizations

- State programs

Each of these avenues offers unique support options tailored to families in need.

It’s important to recognize that these sources vary in eligibility requirements and coverage. By familiarizing yourself with these differences, you can find the best fit for your situation. Remember, you are not alone in this journey; we’re here to help you explore these options and find the support that is right for you. Your comfort and peace of mind are our priority.

Introduction

Navigating the complexities of respite care can feel overwhelming for families. It’s natural to be concerned about the various funding sources and eligibility requirements. As caregivers strive to balance their responsibilities with the need for support, understanding Medicare’s coverage options becomes essential, especially for those involved in hospice care. In addition to Medicare, there are avenues like Medicaid, Veterans Affairs, and private insurance that can provide crucial assistance. However, each of these options comes with its own set of criteria and limitations.

This article delves into the intricacies of respite care funding, the associated costs, and the critical eligibility requirements that families must understand to secure the necessary support for their loved ones. By shedding light on these aspects, we aim to empower families to make informed decisions that alleviate the burdens of caregiving. Your comfort and the well-being of your loved ones are our priorities, and together, we can ensure they receive the care they deserve.

Medicare Coverage for Respite Care

Medicare primarily offers temporary assistance under the hospice benefit of Part A, allowing patients who are utilizing hospice services to receive up to five consecutive days of relief in a Medicare-approved facility. This coverage is specifically tailored for hospice patients, meaning that non-hospice patients do not qualify for these benefits. Understanding the nuances of this coverage is essential for families seeking to optimize their advantages. Temporary assistance can last just a few hours or extend to several weeks, depending on the needs of the caregiver and the individual receiving support. This flexibility empowers families to customize their assistance based on their unique situations, ensuring that caregivers and individuals of all ages—including children, adults, and seniors with special needs or chronic illnesses—receive the necessary help.

Recent statistics reveal that a significant portion of Medicare participants, particularly in states like Rhode Island, are utilizing Medicare Advantage plans, which may offer additional support for relief services. For instance, 59% of Medicare enrollees in Rhode Island are enrolled in such plans, underscoring the growing trend toward these options. Additionally, Humana holds 18% of the Medicare Advantage market share, highlighting the importance of these plans in providing relief benefits.

Experts emphasize the importance of understanding the limitations associated with the Medicare hospice benefit for temporary support. While it provides vital assistance, families must navigate specific eligibility criteria and recognize that the relief benefit is not universally available to all patients. The Hospice Foundation of America notes that many hospice services include bereavement assistance and grief support for the loved ones left behind, highlighting the emotional support accessible through these services.

When selecting a short-term support provider, it is essential for families to look for those with appropriate licensing, positive reviews, experience with similar needs, and clear communication. Real-life examples illustrate how families who pay for respite care have effectively utilized Medicare respite support benefits to alleviate the emotional burden of caregiving. By leveraging available resources and support networks, caregivers can reduce stress and focus on providing quality care to their loved ones. Families have reported that engaging with support networks has significantly helped them manage the emotional challenges of caregiving. For more comprehensive guidance, families are encouraged to consult resources from reputable organizations such as the National Council on Aging.

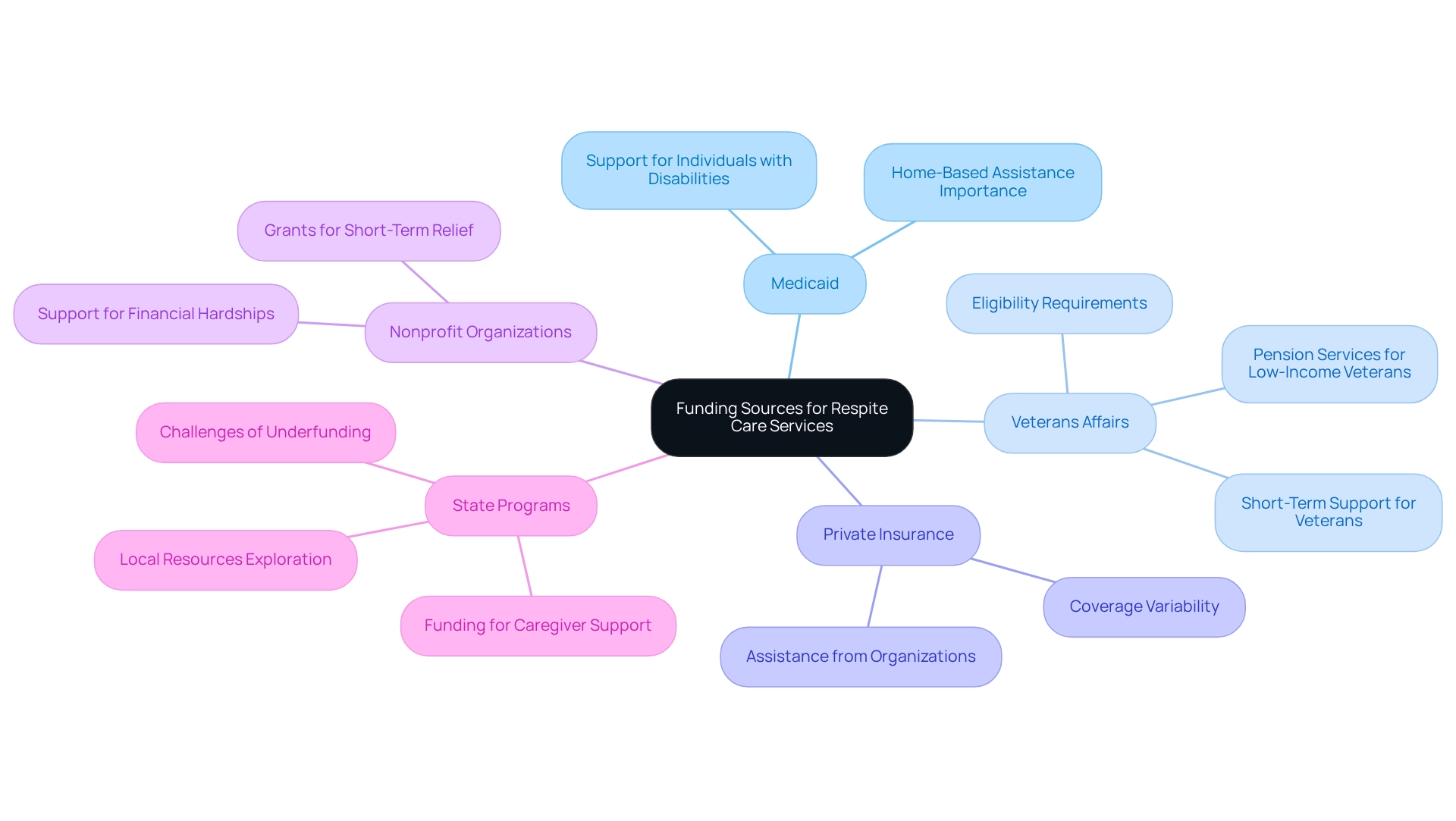

Funding Sources for Respite Care Services

Support services can be financed through various essential sources, each offering unique advantages that can truly make a difference in your journey:

- Medicaid: Many states provide Medicaid programs designed to support qualified individuals, particularly those with disabilities or long-term illnesses. This highlights the vital role of Medicaid in facilitating relief services, emphasizing the importance of home-based assistance for families seeking comfort and care.

- Veterans Affairs (VA): For our veterans, relief benefits through the VA can be a lifeline, covering short-term support in various environments. This assistance is invaluable for many veterans and their families, helping them access essential support while alleviating the burden on primary caregivers. Understanding veteran’s pension services is crucial, as they offer financial aid to low-income veterans who are elderly or disabled. Families are encouraged to explore the VA’s eligibility requirements to see if they qualify for these important benefits.

- Private Insurance: Some private insurance plans may provide coverage for temporary support, although this can vary significantly by policy. It’s important for families to review their insurance options to understand the coverage available. Organizations like Best Care Nurses Registry can assist households in navigating their long-term insurance policies and maximizing their benefits, including a complimentary assessment of LTC insurance.

- Nonprofit Organizations: Numerous nonprofit groups extend grants or financial support specifically for short-term relief, particularly for families facing financial hardships. These resources can be crucial in ensuring that households receive the assistance they need during challenging times.

- State Programs: Many states have established initiatives aimed at supporting caregivers, which may include funding for short-term relief services. However, a recent case study indicates a concerning trend of underfunding these provisions, creating challenges for families seeking help. Households are encouraged to reach out to local organizations to explore available resources and support programs.

Understanding who pays for respite care is essential for families seeking relief services, as it can significantly ease the financial burden associated with caregiving. Remember, you are not alone in this journey; there are resources available to support you.

Eligibility Requirements for Respite Care

Eligibility for respite care can vary significantly depending on the funding source, with several essential criteria typically established to ensure that those who need assistance the most can receive it.

Age and Health Status: Most programs require that the care recipient be a senior or diagnosed with a specific medical condition. This focus ensures that individuals who are most in need of support are prioritized.

Primary Support Person Status: The individual applying for respite care is generally expected to be the primary support person, often a relative who provides the majority of care. Best Care Nurses Registry offers adaptable support services, allowing aides to assist for just a few hours daily or throughout the entire day, based on the family’s needs. Importantly, there is no minimum hour requirement for caregiver services. This raises the question of who pays for respite care, as funding sources such as Medicaid assess financial need as a critical factor in determining eligibility. This process ensures that assistance is directed to those who require it most. With projections indicating that by 2030, many retirees may lack sufficient income and assets to meet essential expenses related to long-term support, understanding who pays for respite care is increasingly vital. Best Support collaborates with most long-term assistance insurance providers, specifically those who cover respite care, accepting Assignment of Benefits (AOB) to simplify the payment process for families.

Program-Specific Requirements: Each funding source may impose unique requirements, including necessary documentation or prior approval processes. Families are encouraged to consult local agencies or specific program guidelines to confirm they meet all criteria. Furthermore, identifying the need for CNA/HHA support services is essential; relatives should evaluate their loved ones’ capacity to perform daily tasks and overall health condition to determine if additional assistance is necessary.

As we approach 2025, understanding these eligibility criteria becomes increasingly important, especially as many retirees face financial challenges that may hinder their ability to manage long-term support expenses. Notably, a significant portion of caregivers—approximately 43.4%—are family members, with around 14.5 million of these individuals being males. This statistic underscores the importance of support systems within caregiving networks. Studies reveal that only about 20% of those providing support serve as the exclusive source of assistance, often relying on a broader group of unpaid contributors. As the landscape of support providers evolves, it is clear that the challenges faced by these individuals are both complex and persistent. This reality highlights the necessity for available relief services that can alleviate the pressures on primary supporters, enabling them to maintain their well-being while ensuring their loved ones receive the essential assistance they need.

Cost Considerations for Respite Care

The cost of respite care can vary significantly based on several key factors, and understanding these can help ease your concerns:

- Type of Care: In-home respite care typically ranges from $15 to $40 per hour, while facility-based care can cost between $200 and $300 per day. This clear distinction emphasizes the significance of assessing the most appropriate choice for both the provider and the recipient of assistance.

- Location: Geographic location plays a crucial role in pricing, with urban areas generally commanding higher rates compared to rural settings. Families should research who pays for respite care in their area to make informed decisions about local costs.

- Duration of Care: The length of stay can influence overall expenses. Although prolonged stays might result in increased expenses, numerous establishments provide discounts for extended services, making it important to ask about such alternatives.

- Level of Assistance Required: Specialized support for individuals with complex medical needs often incurs higher costs. Families should assess the specific requirements of their loved ones to understand the potential financial implications.

In 2025, the average daily rate for short-term stays in nursing homes ranges from $280 to $315, underscoring the financial considerations involved. Furthermore, groups such as the Alzheimer’s Association provide financing alternatives for temporary assistance, which can help clarify who pays for respite care and reduce some of the financial pressures on families.

As Matthew Clem, a registered nurse, observes, “It’s a supplement to ongoing support that can be very advantageous to both the provider and the recipient of assistance.” This viewpoint emphasizes the importance of relief support, particularly for those providing assistance who might face financial pressure because of their duties. Real-life examples demonstrate the cost differences between in-home and facility-based respite services. For instance, a household choosing in-home support may discover it more economical and adaptable, allowing them to preserve a familiar setting for their loved one. On the other hand, facility-based support may provide more comprehensive services but at a higher cost.

Financial advisors frequently recommend that families consider who pays for respite care when thoughtfully evaluating the expenses of in-home versus facility-based services. The financial strain on caregivers, many of whom juggle employment alongside caregiving responsibilities, can impact their long-term financial stability. Therefore, exploring all available funding options and understanding the costs associated with different care types is crucial for effective planning.

Conclusion

Navigating the world of respite care funding can feel overwhelming, but understanding the options available is crucial for families seeking support. Medicare offers essential respite care coverage for hospice patients, allowing for up to five days of care in approved facilities. This benefit, however, is limited to those in hospice, making it vital to be aware of eligibility criteria and the nuances of coverage. In addition, families can explore various funding sources, such as:

- Medicaid

- Veterans Affairs

- Private insurance

- Nonprofit organizations

to help ease the financial burden associated with caregiving.

Eligibility requirements for respite care differ by funding source, often focusing on age, health status, and primary caregiver status. Families must navigate these criteria thoughtfully to secure the necessary assistance for their loved ones. Furthermore, understanding the costs associated with different types of respite care—whether in-home or facility-based—can significantly impact decision-making. With prices varying widely based on care type, location, and duration, families are encouraged to weigh their options carefully.

Ultimately, securing respite care is essential for both caregivers and their loved ones. By leveraging available resources and understanding the funding landscape, families can reduce stress and enhance their ability to provide quality care. Prioritizing respite care not only benefits those receiving care but also supports caregivers in maintaining their well-being, ensuring they can continue their vital role in the lives of their loved ones. Remember, you are not alone in this journey; we’re here for you every step of the way.

Frequently Asked Questions

What type of assistance does Medicare offer under the hospice benefit of Part A?

Medicare offers temporary assistance under the hospice benefit of Part A, allowing hospice patients to receive up to five consecutive days of relief in a Medicare-approved facility.

Who qualifies for the temporary assistance provided by Medicare’s hospice benefit?

The temporary assistance is specifically tailored for hospice patients, meaning that non-hospice patients do not qualify for these benefits.

How long can temporary assistance last under the hospice benefit?

Temporary assistance can last from just a few hours to several weeks, depending on the needs of the caregiver and the individual receiving support.

What types of individuals can receive support through the hospice benefit?

Individuals of all ages, including children, adults, and seniors with special needs or chronic illnesses, can receive support through the hospice benefit.

What percentage of Medicare enrollees in Rhode Island are utilizing Medicare Advantage plans?

Approximately 59% of Medicare enrollees in Rhode Island are enrolled in Medicare Advantage plans, which may offer additional support for relief services.

What is the significance of Humana in the Medicare Advantage market?

Humana holds 18% of the Medicare Advantage market share, indicating its importance in providing relief benefits to Medicare participants.

What should families understand about the limitations of the Medicare hospice benefit?

Families must navigate specific eligibility criteria and recognize that the relief benefit is not universally available to all patients.

What additional support services are often included with hospice services?

Many hospice services include bereavement assistance and grief support for the loved ones left behind.

What factors should families consider when selecting a short-term support provider?

Families should look for providers with appropriate licensing, positive reviews, experience with similar needs, and clear communication.

How can families effectively utilize Medicare respite support benefits?

Families can effectively utilize Medicare respite support benefits by engaging with support networks, which can help alleviate the emotional burden of caregiving.