Overview

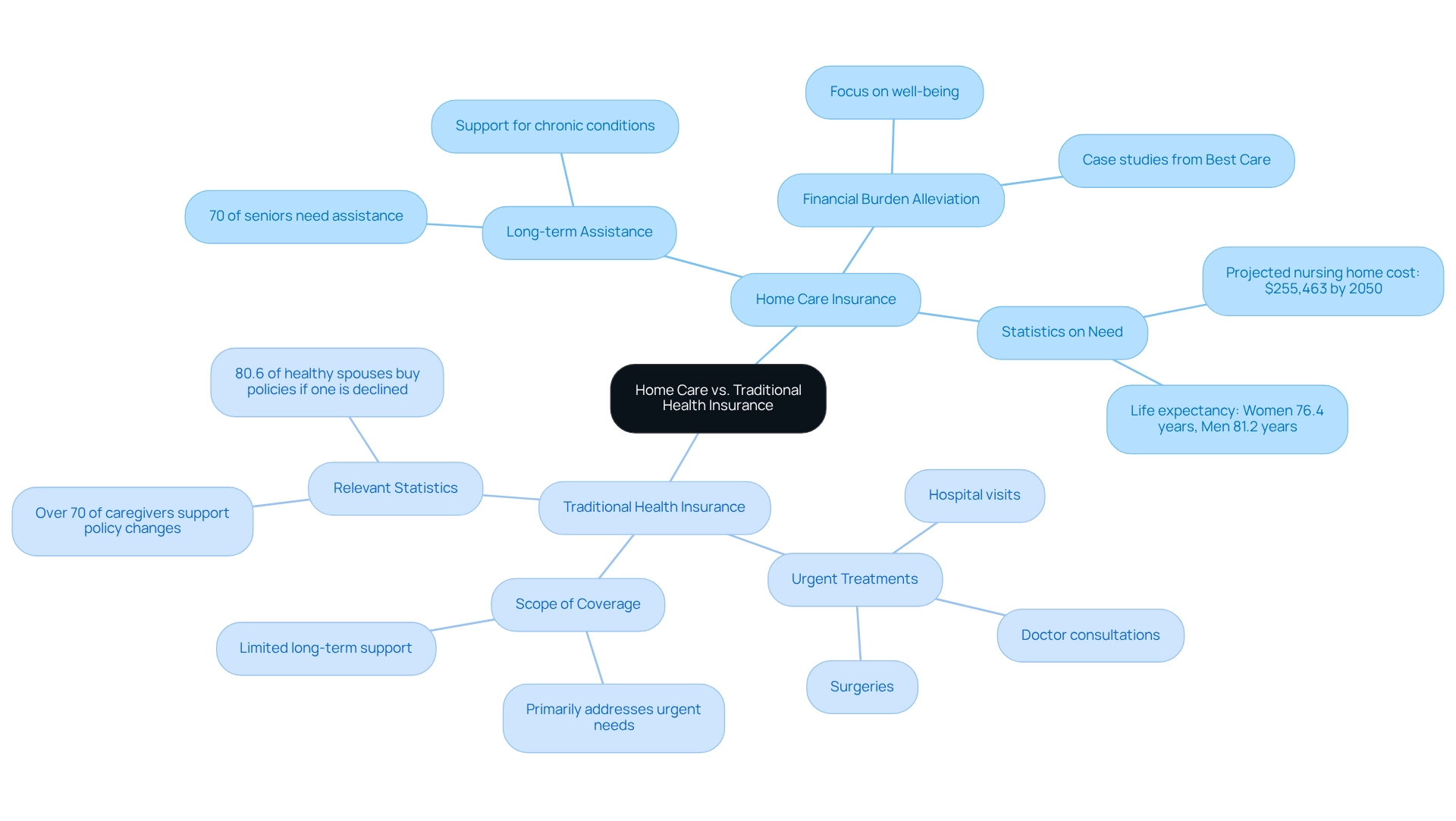

Home care insurance stands apart from traditional health insurance by focusing on long-term assistance for daily living activities. While traditional health insurance typically addresses urgent medical treatments, home care insurance is vital for seniors who may need ongoing support due to chronic conditions. Unfortunately, conventional coverage often overlooks these long-term needs, which can lead to significant risks and financial burdens for families.

It’s important to recognize the emotional weight that comes with caring for a loved one. Many families find themselves in challenging situations, feeling overwhelmed by the complexities of care. Home care insurance can provide peace of mind, ensuring that your loved ones receive the support they truly need.

In addition, having this coverage means that families can focus on what matters most—spending quality time with their seniors, rather than worrying about financial strains. We’re here for you, ready to help navigate these important decisions. Your comfort and the well-being of your family are our top priorities.

Introduction

In the complex landscape of healthcare, understanding the differences between home care insurance and traditional health insurance is crucial for families planning for long-term care needs. As individuals age, the likelihood of requiring assistance with daily activities increases. Yet, many families remain unaware of the specific benefits that home care insurance can offer. While traditional health insurance primarily covers acute medical expenses, it often falls short in addressing the ongoing support required for chronic conditions and disabilities.

With statistics indicating that a significant portion of seniors will need long-term care, the importance of choosing the right insurance becomes clear. This article delves into the nuances of these insurance types, exploring their coverage options, financial implications, and suitability for different care needs. We aim to guide families toward informed decisions that ensure their loved ones receive the care they deserve. Remember, your comfort and peace of mind are our priority, and we’re here to support you every step of the way.

Understanding Home Care Insurance and Traditional Health Insurance

Home support coverage is thoughtfully designed to include long-term assistance services, such as help with daily activities like bathing, dressing, and meal preparation. This type of coverage is especially beneficial for individuals who require continuous assistance due to chronic conditions or disabilities. In contrast, conventional medical coverage primarily addresses expenses related to urgent treatments, such as hospital visits, surgeries, and doctor consultations. While both types of coverage aim to provide financial assistance for health-related needs, their scopes and coverage options differ significantly, particularly regarding long-term support necessities for seniors.

Recent statistics from the Kaiser Family Foundation reveal that approximately 70% of individuals aged 65 and older will need some form of long-term assistance during their lifetime. This underscores the importance of personal support coverage, such as home care insurance, which offers tailored advantages that conventional health plans often overlook. For instance, personal support coverage can alleviate the financial burden associated with long-term assistance, as demonstrated by case studies where families received help with long-term support claims from Best Care Nurses Registry. This support enables families to focus on the well-being of their loved ones rather than navigating the complex processes of home care insurance coverage. Moreover, the average life expectancy for women is 76.4 years, while for men it is 81.2 years, highlighting the increasing likelihood that seniors will require extended support. As the anticipated median yearly nursing home expense for a private room is projected to reach $255,463 by 2050, the financial implications of lacking sufficient home care insurance become evident. Additionally, it is noteworthy that 80.6% of healthy partners choose to purchase long-term support policies if one partner is denied coverage. This statistic reflects the proactive steps families take to prepare for future assistance needs.

Without CNA/HHA services, seniors face significant risks, including deterioration, poor nutrition, hygiene issues, mobility challenges, social isolation, household hazards, and medication management problems. These factors can severely impact their quality of life. Therefore, understanding the key distinctions between home care insurance and conventional health coverage is crucial for seniors and their families as they prepare for future assistance needs. We’re here for you, ensuring that your comfort and well-being remain our top priority.

Coverage Options: What Home Care Insurance Includes

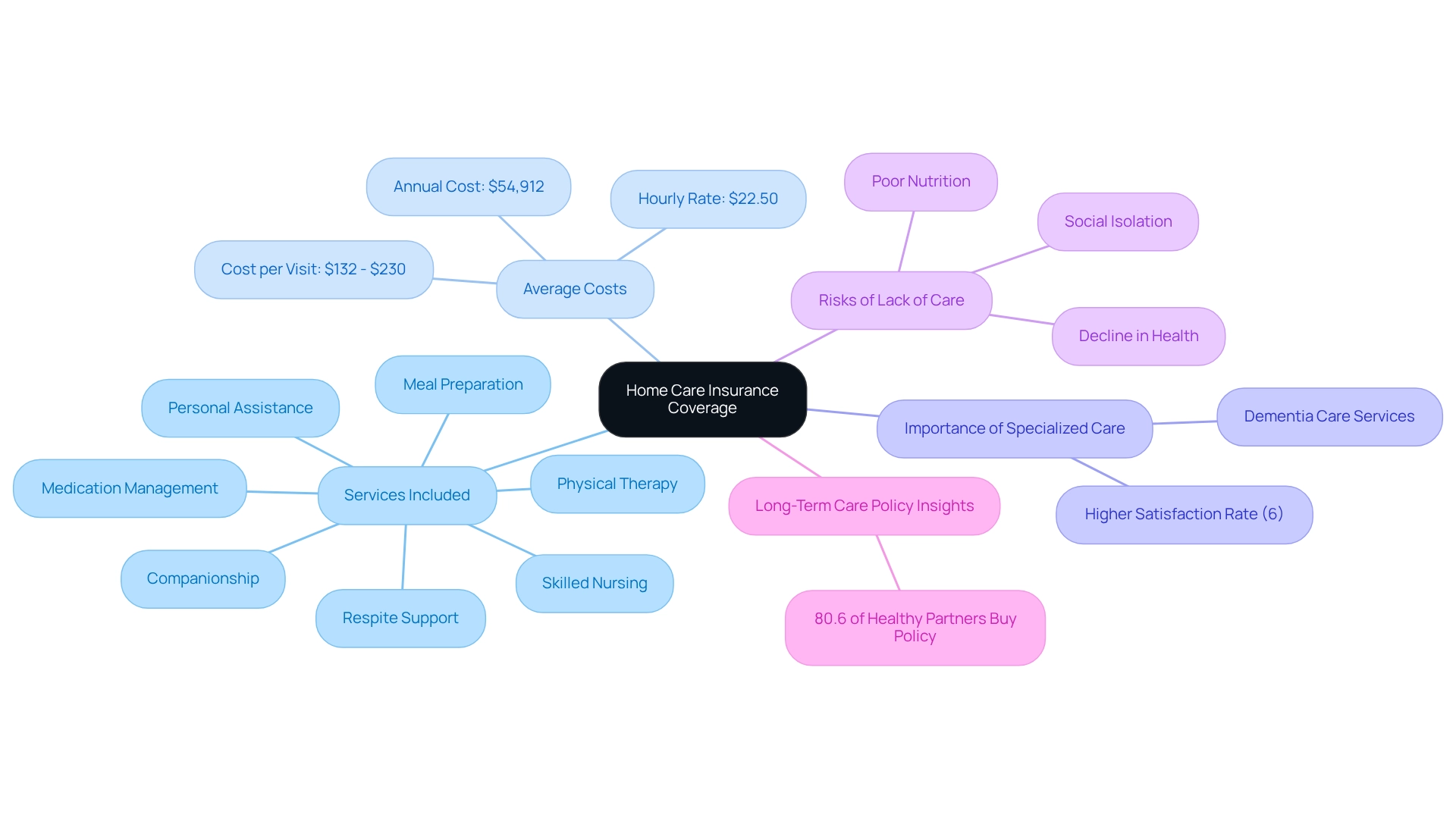

Home support insurance offers a compassionate range of services tailored to assist individuals with daily living activities. Coverage typically includes personal assistance services such as bathing, grooming, and dressing, along with companionship, meal preparation, and medication management. Many policies also provide skilled nursing services, physical therapy, and respite support for family caregivers, delivering essential help during challenging times.

In 2025, the average yearly cost of at-home services in the U.S. is approximately $54,912, with hourly rates averaging $22.50. According to AARP, the cost per appointment for in-home medical assistance ranges from $132 to $230, depending on the state and area. This financial aspect underscores the importance of understanding what home care insurance coverage entails, as it can significantly alleviate the burden of these expenses. Unlike traditional medical coverage, which often imposes limits on the types of care included, home support policies are designed to offer flexibility and comprehensive assistance tailored to individual needs.

Moreover, research indicates that agencies specializing in dementia services boast a client satisfaction rate that is 6% higher than those that do not, highlighting the value of specialized care. As families consider their options, it becomes crucial to evaluate the specific services included in home care insurance policies, ensuring they meet the unique needs of their loved ones. The risks faced by seniors without CNA/HHA services—such as decline, poor nutrition, and social isolation—further emphasize the necessity of professional caregiving. Additionally, it is noteworthy that 80.6% of healthy partners opt for a long-term assistance policy if one partner is denied coverage, illustrating the importance of preparing for future support needs. This consideration is vital when weighing the benefits and drawbacks of home care insurance compared to traditional medical insurance.

Limitations of Traditional Health Insurance for Home Care Needs

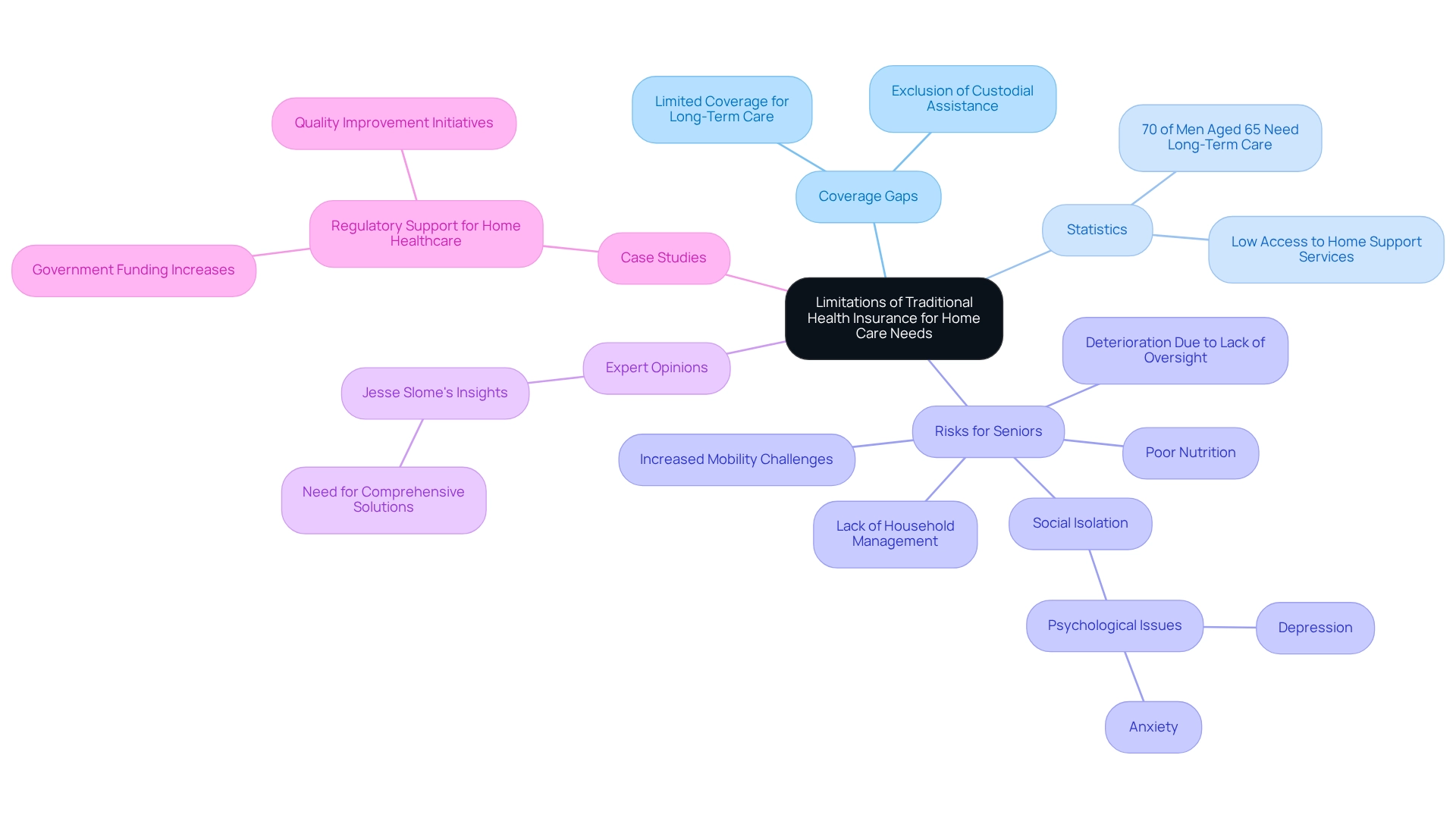

Conventional home care insurance often falls short of fully meeting the needs of domestic support. Many plans offer limited coverage for domestic medical services, typically restricted to short-term, essential treatments post-hospitalization. For example, while Medicare may cover certain domestic support services, it usually excludes custodial assistance, which is vital for individuals requiring help with daily living activities over an extended period. This gap in coverage can place families in a difficult position, as they strive to find affordable home care insurance for their loved ones.

Statistics reveal that only a small percentage of Medicare recipients access home support services, highlighting the inadequacy of traditional coverage and the necessity of home care insurance to meet the growing demand for long-term assistance. A recent analysis indicated that around 70% of men currently aged 65 will need long-term care at some point in their lives, underscoring the urgent need for home care insurance that conventional coverage often neglects. Many families struggle to navigate the complexities of insurance coverage, leading to increased out-of-pocket expenses and stress.

Without CNA/HHA caregiver services, seniors face significant risks, including:

- Deterioration due to a lack of medical oversight

- Poor nutrition from inadequate meal preparation

- Increased mobility challenges that can lead to falls

- Social isolation from the absence of companionship, resulting in psychological issues such as depression and anxiety

- Lack of household management and medication oversight

Case studies illustrate the real-world consequences of these limitations. Families often feel overwhelmed by the responsibility of caregiving, compounded by the emotional strain of managing health-related issues without the support that home care insurance can provide. Regulatory agencies have acknowledged these challenges, implementing policies aimed at improving home healthcare delivery, such as reimbursement reforms and quality enhancement initiatives. However, the fundamental limitations of conventional medical coverage continue to pose a significant barrier.

Medical experts have voiced concerns regarding the shortcomings of traditional medical coverage for extended support. Jesse Slome, founder and director of the American Association for Medicare Supplement Coverage, emphasizes the need for more comprehensive solutions, stating, “Traditional health coverage often leaves families without the essential support for long-term assistance requirements.” As the healthcare landscape evolves, it becomes increasingly clear that home care insurance may provide a more viable alternative for families seeking the necessary assistance for their loved ones, ensuring they receive the support needed to maintain their quality of life. Furthermore, patient satisfaction surveys play a crucial role in assessing the quality of residential healthcare services, further highlighting the importance of adequate coverage. For more information on how Best Care Nurses Registry can assist you, please call (888) 203-2529 to schedule a consultation.

Cost Analysis: Comparing Financial Implications of Both Insurance Types

When considering the financial aspects of home care insurance in comparison to conventional medical coverage, it’s important to acknowledge the concerns many families face. Home protection policy premiums typically range from $2,000 to $4,000 annually, influenced by the level of coverage, the insured’s age, and their health condition. While conventional health coverage may seem to offer lower monthly costs, it often results in substantial out-of-pocket expenses for services not included, particularly long-term support services.

For instance, a study involving 3,730 clients revealed that the average premium for long-term support was $3,152 for married couples, with clients usually securing an average of 3.57 years of coverage. This underscores the importance of evaluating not only the premiums but also the potential out-of-pocket costs associated with each type of coverage. Families must thoughtfully weigh these factors to determine which option provides better financial security for their support needs, especially given that U.S. health expenditures rose by 9.7% in 2020, totaling $4.1 trillion.

As the average age of new buyers increased to 57 in 2023, the demand for personalized coverage options is likely to grow, highlighting the necessity for informed decision-making in this critical area. Notably, the longest claim recorded was from a client who paid four years of premiums before submitting a claim, illustrating the long-term financial commitment tied to home support policies.

Sandy Baker noted that the need for long-term coverage is expected to rise at a rate faster than the number of available professionals, emphasizing the importance of considering residential support plans as demand escalates. Furthermore, Best Care Nurses Registry accepts most long-term support policies directly, allowing clients to instruct their providers to cover services without upfront costs, aside from any waiting periods. This flexibility in payment options enhances the financial sustainability of residential support services.

It’s crucial to remember that Medicare does not cover essential activities of daily living such as bathing, grooming, and meal preparation—services that are vital and provided by Best Care Nurses Registry. A straightforward comparison of out-of-pocket costs for home support versus conventional coverage is essential, as families need to understand the financial implications of each choice related to home care insurance. Remember, we’re here for you, guiding you through these important decisions.

Suitability: Which Insurance Type is Right for You?

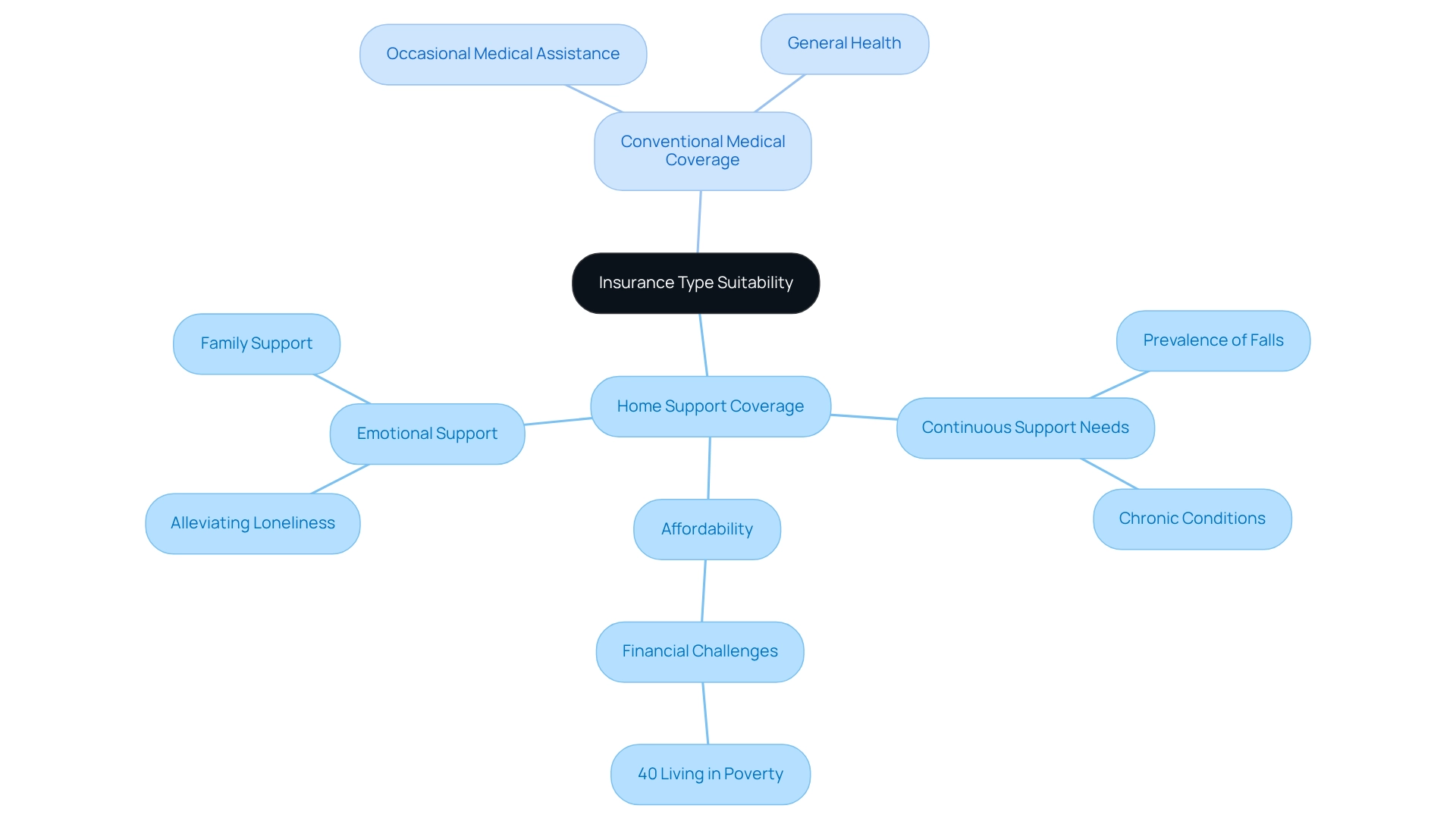

Choosing the right type of coverage—home support coverage or conventional medical coverage—depends on your unique situation and assistance needs. For older adults or individuals with ongoing conditions requiring continuous support, in-home assistance often stands out as the more fitting option. It offers comprehensive coverage tailored for long-term support needs, which is especially important considering that one in four adults over 65 experiences a fall each year. This statistic underscores the vital role of in-home caregivers in enhancing safety and minimizing risks.

Home assistance is not only more affordable and convenient, but it also proves to be just as effective as treatment received in a hospital or nursing facility. It provides emotional support that can help alleviate feelings of loneliness and anxiety for seniors and their families. Furthermore, the home support sector has shown significant growth, with an expected annual increase of 4.2% following a period of stagnation. This trend highlights the increasing importance of home care insurance as more families seek these essential services. Conversely, individuals who are generally healthy and only require occasional medical assistance might find that conventional medical coverage meets their needs. Families should conduct a thorough assessment of their loved ones’ health status, support requirements, and financial situation to make an informed decision. Notably, 40% of the elderly population with long-term support needs live in poverty or near poverty, adding a financial dimension to the coverage decision that families must carefully consider.

As the population of individuals over 85 continues to grow, particularly among those residing in assisted living facilities, understanding the nuances of these coverage options becomes increasingly crucial. Additionally, experts recommend that seniors with chronic conditions prioritize home care insurance, as it aligns more effectively with their long-term support needs. This approach not only guarantees comprehensive assistance but also alleviates the emotional and logistical challenges often faced by families.

At Best Care Nurses Registry, we are dedicated to providing high-quality support that helps families navigate the complexities of long-term care. It’s important to choose a provider that aligns with your selected coverage type. By thoughtfully considering these factors, families can secure the essential support needed for future care, ultimately enhancing the quality of life for their loved ones. To learn more about how Best Care Nurses Registry can assist you in navigating your home care insurance options, please contact us at (888) 203-2529 or schedule a consultation today.

Conclusion

Understanding the distinctions between home care insurance and traditional health insurance is essential for families planning for long-term care. Home care insurance specifically caters to individuals who require ongoing assistance due to chronic conditions or disabilities, covering vital services like personal care, companionship, and skilled nursing. In contrast, traditional health insurance mainly addresses acute medical expenses and often lacks the comprehensive support necessary for long-term care. This gap can lead families to face significant challenges in securing affordable and adequate care for their loved ones.

The financial implications of these insurance types cannot be overlooked. While home care insurance may entail higher premiums, it provides crucial coverage that can alleviate the substantial costs associated with long-term care, which traditional health insurance typically fails to cover. As the demand for long-term care continues to rise, understanding the specific coverage options and limitations of each insurance type is vital for families aiming to ensure their loved ones receive the appropriate support.

In conclusion, selecting the right insurance type is a critical decision that hinges on individual circumstances and care needs. For those with chronic conditions or who are aging, home care insurance often proves to be the more suitable option, providing tailored coverage that enhances safety and quality of life. Families must carefully evaluate their loved ones’ health status, care requirements, and financial situations to make informed choices that will secure the necessary support for future care needs. By prioritizing the right insurance, families can ensure their loved ones receive the care they deserve, ultimately promoting a better quality of life.

Frequently Asked Questions

What is home support coverage designed to include?

Home support coverage is designed to include long-term assistance services such as help with daily activities like bathing, dressing, and meal preparation, which is especially beneficial for individuals requiring continuous assistance due to chronic conditions or disabilities.

How does home support coverage differ from conventional medical coverage?

Home support coverage primarily addresses long-term assistance needs, while conventional medical coverage focuses on urgent treatments like hospital visits, surgeries, and doctor consultations. Their scopes and coverage options differ significantly, particularly regarding long-term support for seniors.

What percentage of individuals aged 65 and older will need long-term assistance during their lifetime?

Approximately 70% of individuals aged 65 and older will need some form of long-term assistance during their lifetime.

Why is personal support coverage important?

Personal support coverage, such as home care insurance, alleviates the financial burden associated with long-term assistance and provides tailored advantages that conventional health plans often overlook.

What are the projected costs of nursing home care by 2050?

The anticipated median yearly nursing home expense for a private room is projected to reach $255,463 by 2050.

What risks do seniors face without CNA/HHA services?

Seniors without CNA/HHA services face significant risks including deterioration, poor nutrition, hygiene issues, mobility challenges, social isolation, household hazards, and medication management problems, which can severely impact their quality of life.

What types of services does home support insurance typically cover?

Home support insurance typically covers personal assistance services such as bathing, grooming, dressing, companionship, meal preparation, medication management, skilled nursing services, physical therapy, and respite support for family caregivers.

What is the average yearly cost of at-home services in the U.S. as of 2025?

The average yearly cost of at-home services in the U.S. is approximately $54,912, with hourly rates averaging $22.50.

How does home care insurance alleviate financial burdens?

Home care insurance alleviates financial burdens by covering costs associated with long-term assistance, which can be significant, especially when compared to traditional medical coverage that often has limits on included care types.

What is the client satisfaction rate for agencies specializing in dementia services?

Agencies specializing in dementia services boast a client satisfaction rate that is 6% higher than those that do not specialize in such care.